There are five (5) sections on this how-to guide. Make sure that you have completed the previous section before moving on to the next.

I. SETTING IT UPII. CREATING A VENDOR BILL WITH LANDED COSTIII. EXPORTING TO QUICKBOOKSIV. CHECKING QUICKBOOKS LANDED COST EXPENSEV. EFFECTS ON COST OF GOODS SOLD

💡

I. SETTING IT UP

1. QuickBooks

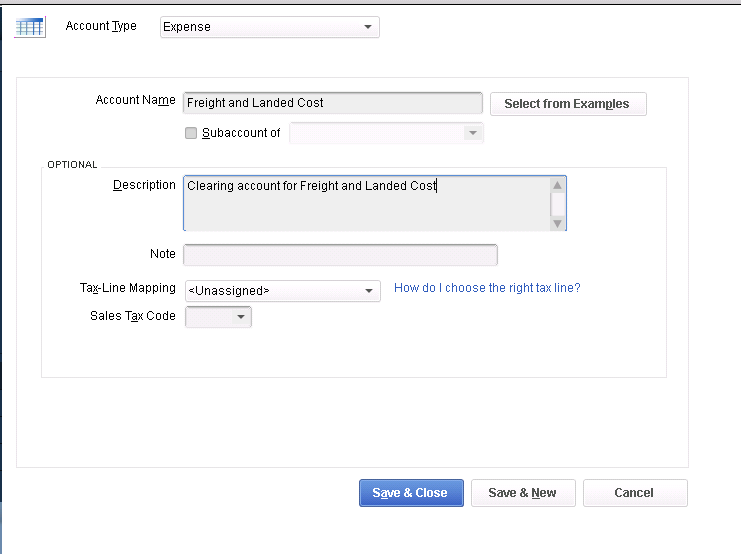

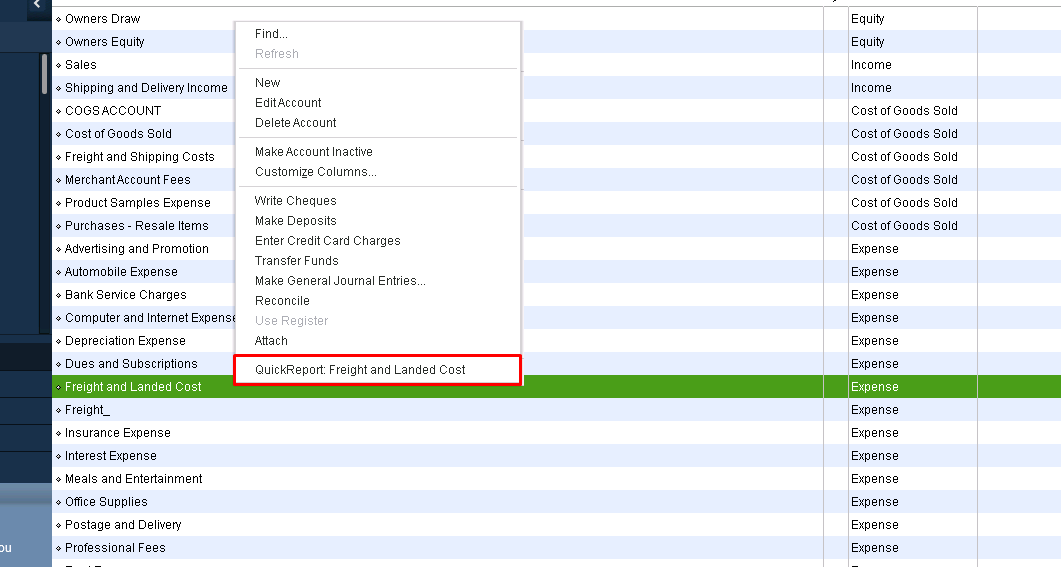

- Clearing Account (Expense) for Landed Costs

- Go to: Chart of Accounts >> New Expense Account >> "Freight and Landed Cost" or any name of your choice

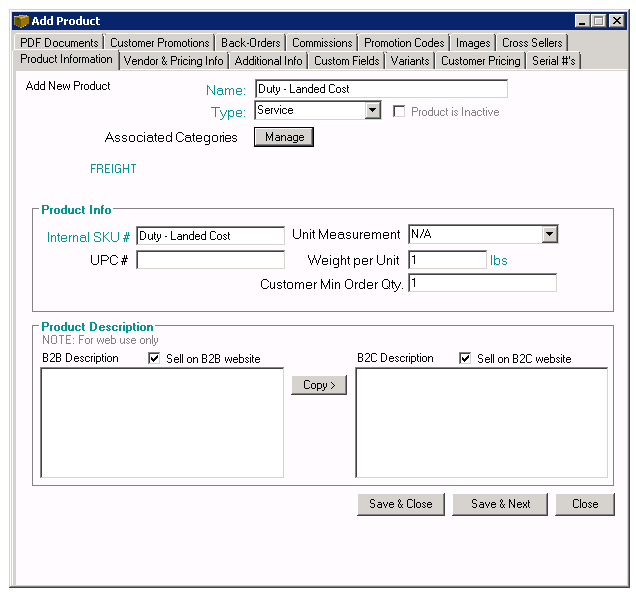

2. AdvancePro

Create the following items on AdvancePro:

- Service Item: "Duty - Landed Cost"

- Vendor: "Landed Cost Vendor"

- Product Category: "FREIGHT"

- Assign the Service Item to the Category

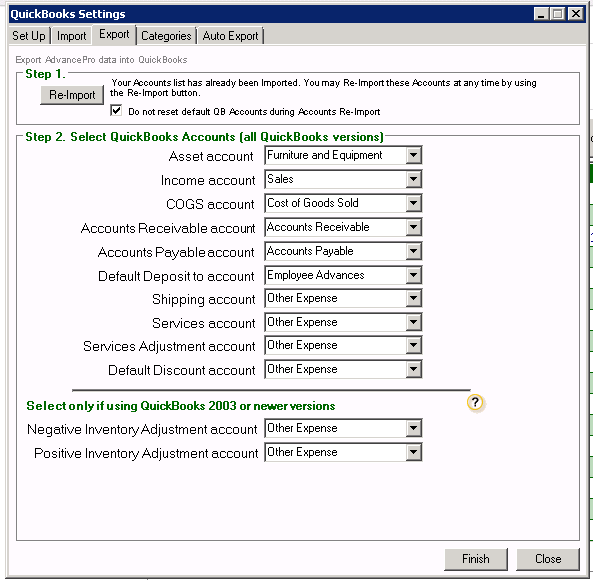

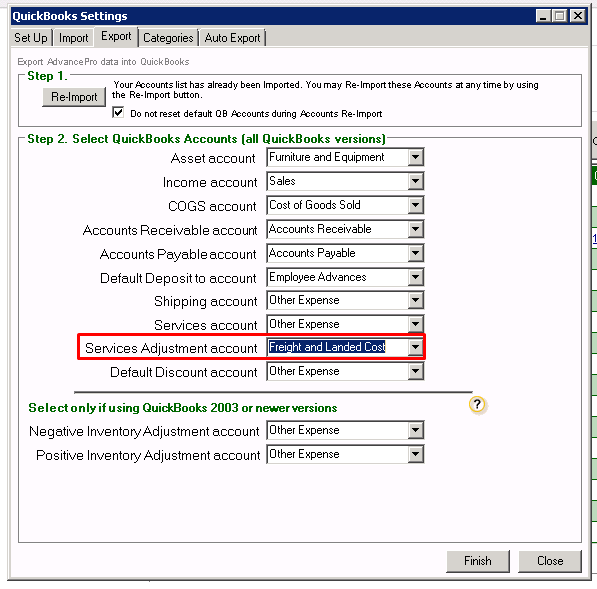

3. Update AdvancePro's Chart of Accounts

- Check the box "Do not reset default QuickBooks Accounts during Accounts Re-Import"

- Click Re-Import

Assign "Freight and Landed Cost" as the Expense Account of the Category, FREIGHT

- Go to QuickBooks Tab >> Settings >> Categories Tab

- Select the Category >> Select appropriate Expense Account

4. EXPORT ALL RELATED ITEMS ON QUICKBOOKS

NOTE: Do not make any Vendor Bills/Transactions yet

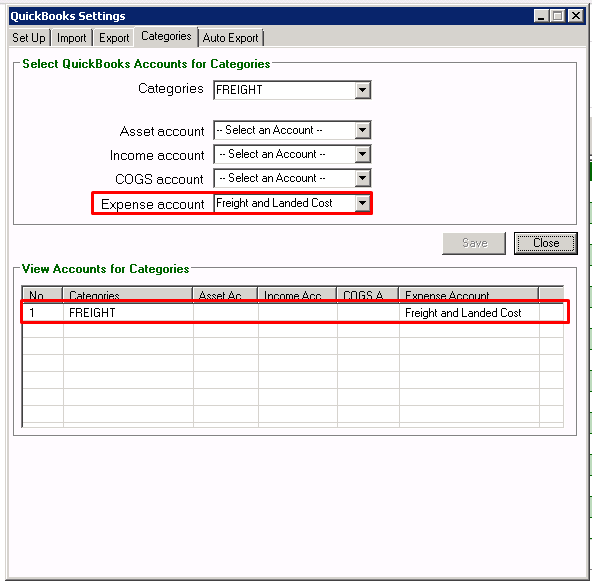

1. PRODUCT - SERVICE ITEM

2. VENDOR - FOR SERVICE ITEM

Confirm the Product's Expense Account on QuickBooks if it has been set to "Freight and Landed Cost" Account

STOP!

Have you completed all the setup on this section? If you have, you can proceed to the next setup:

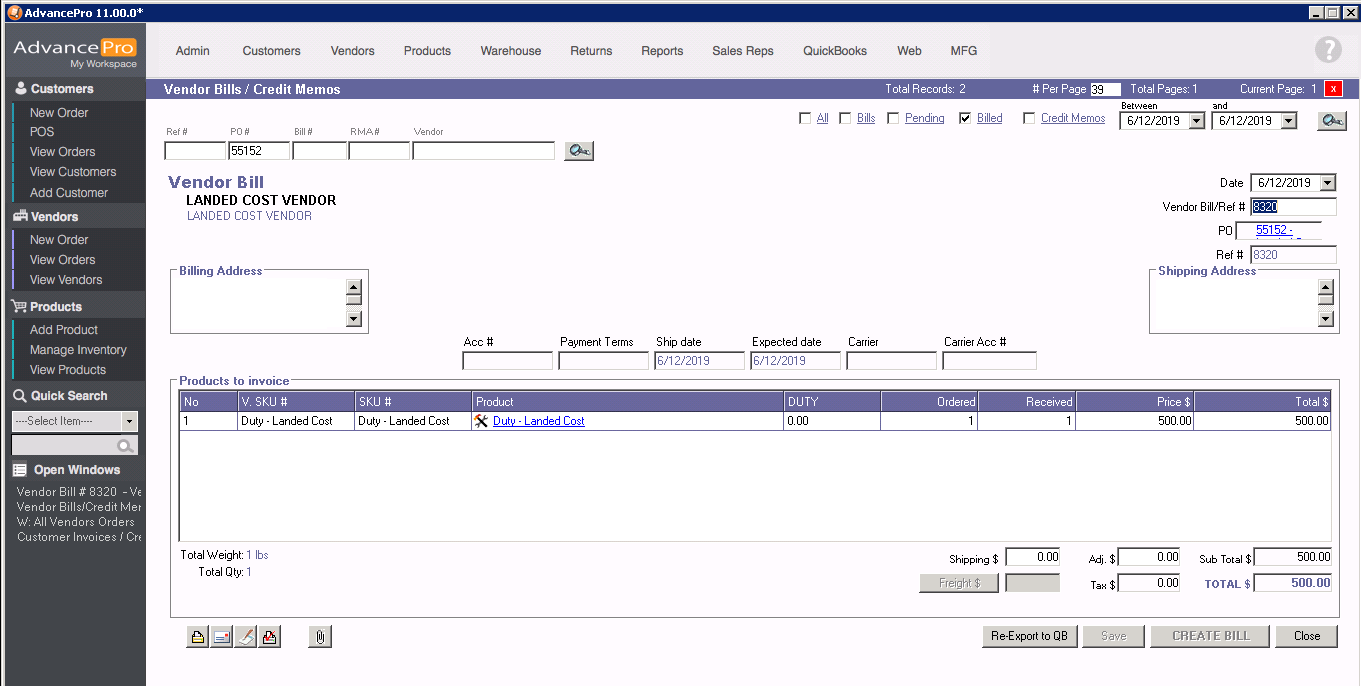

II. CREATING A VENDOR BILL WITH LANDED COST

💡

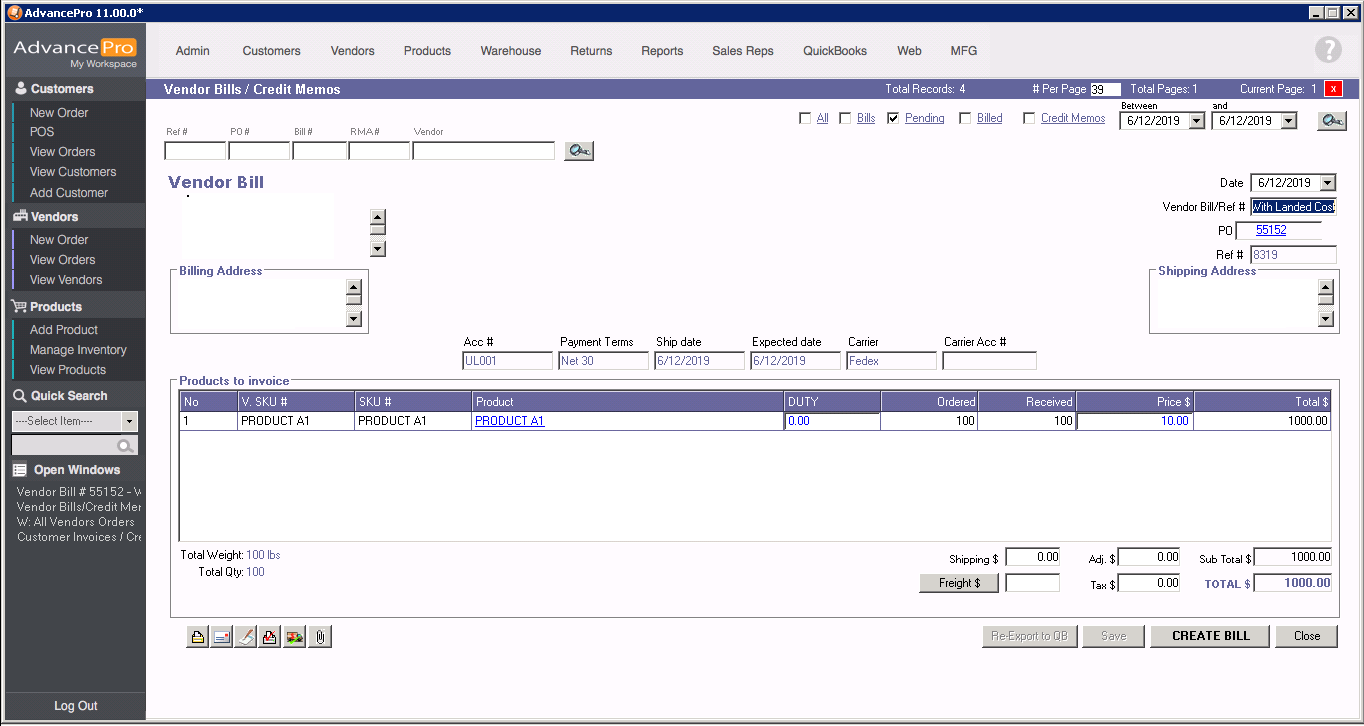

II. CREATING A VENDOR BILL WITH LANDED COST

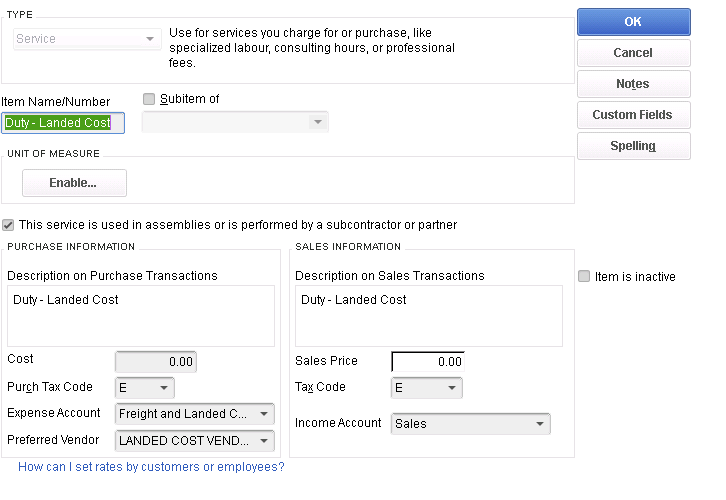

PRODUCT: PRODUCT A1

COST: $10.00

QUANTITY: 100

TOTAL: $1000.00

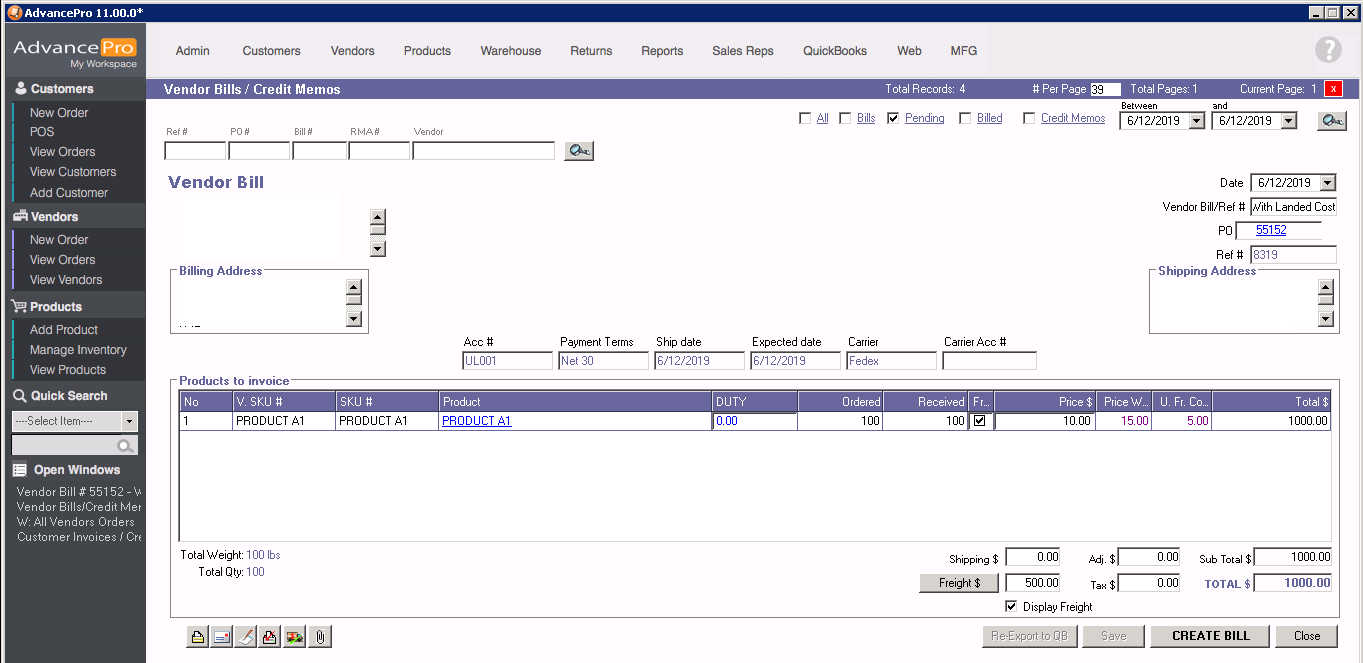

On a Pending Vendor Bill* click on the FREIGHT $** Button

*Landed Cost can only be applied on a Pending Vendor Bill

**Only available if the FREIGHT Module is activated. If not, please contact support

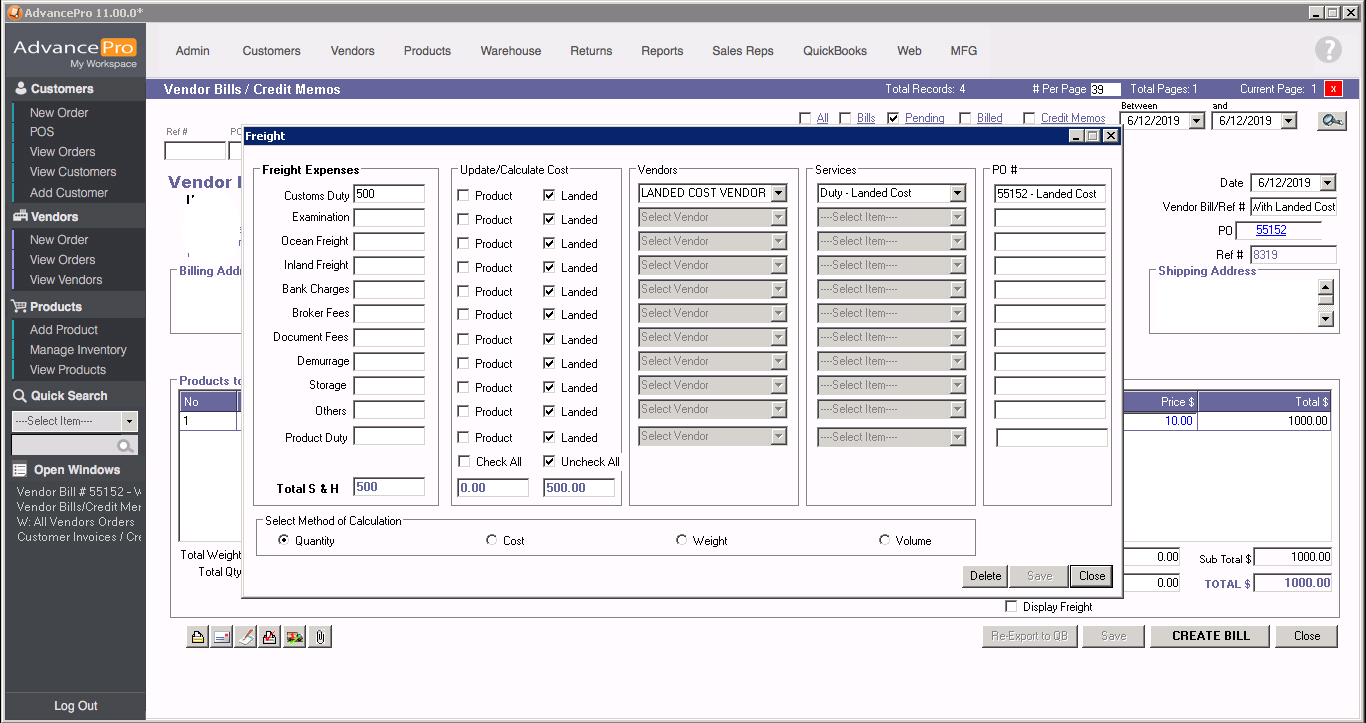

Enter the appropriate Landed Cost amount, the Landed Cost Vendor, the Service Item for Landed Cost, and the PO# for this Freight Bill

Available Freight Expenses can be seen on the screenshot below. Total Shipping and Handling is calculated (can be set as Qty, Cost, Weight, or Volume calculation).

LANDED COST of $500.00 has now been associated with the order.

Check Display Freight to show the Price with Freight and the Per Unit Freight columns

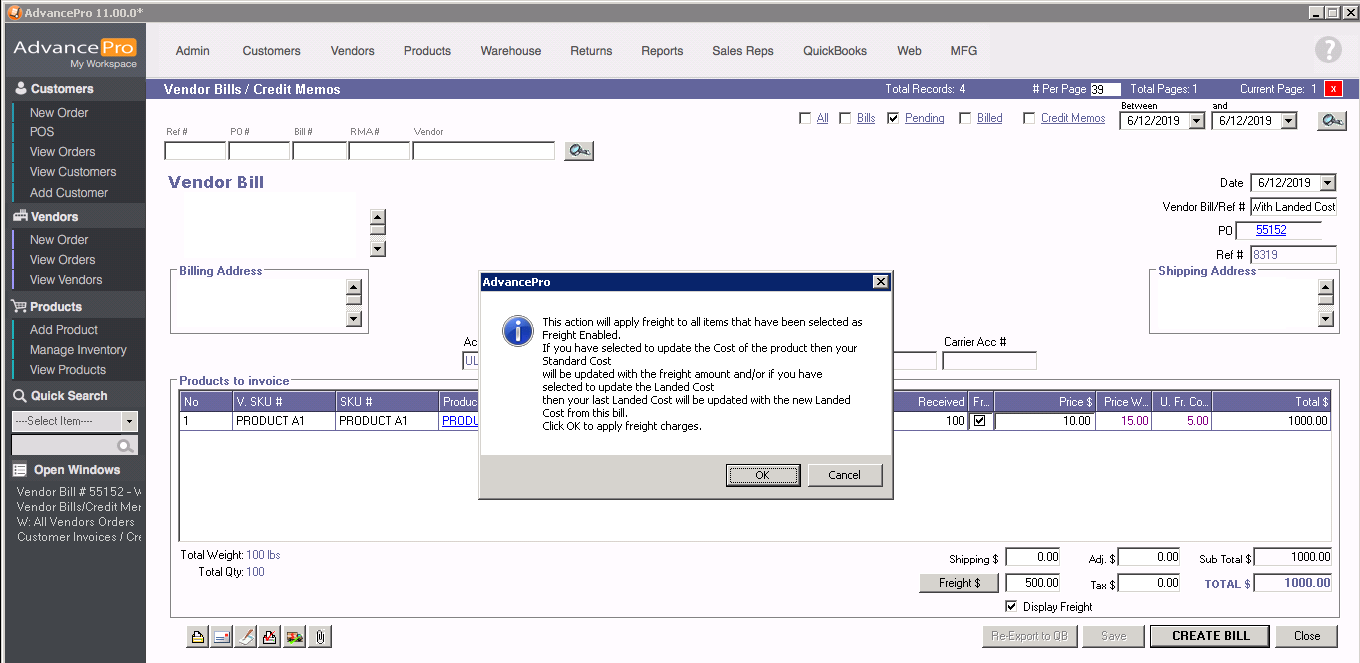

CREATE THE BILL.

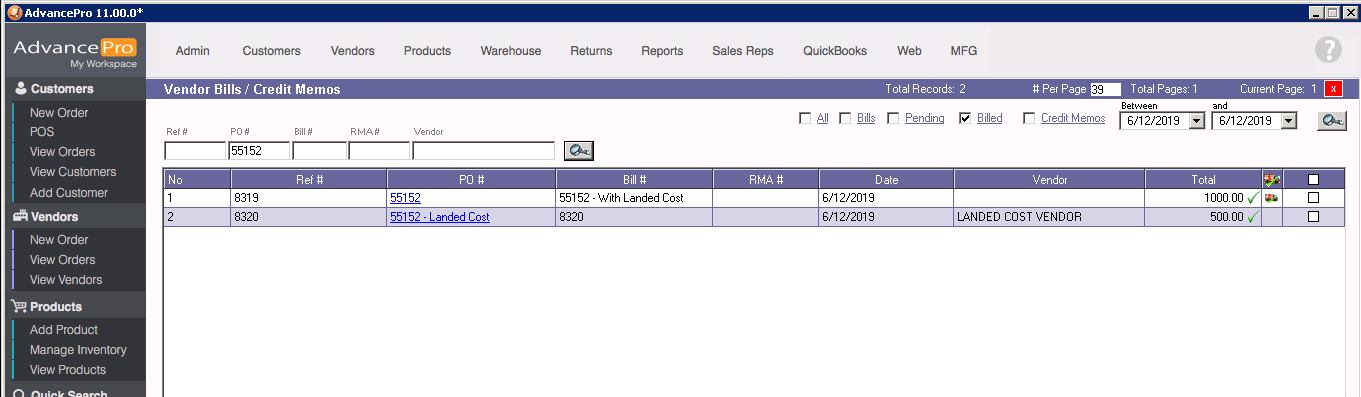

This will trigger the system to create two bills: The original Bill for the purchase, and the Landed Cost Bill

STOP!

Have you completed all the setup on this section? If you have, you can proceed to the next setup:

III. EXPORTING TO QUICKBOOKS, AVERAGE COSTS

💡

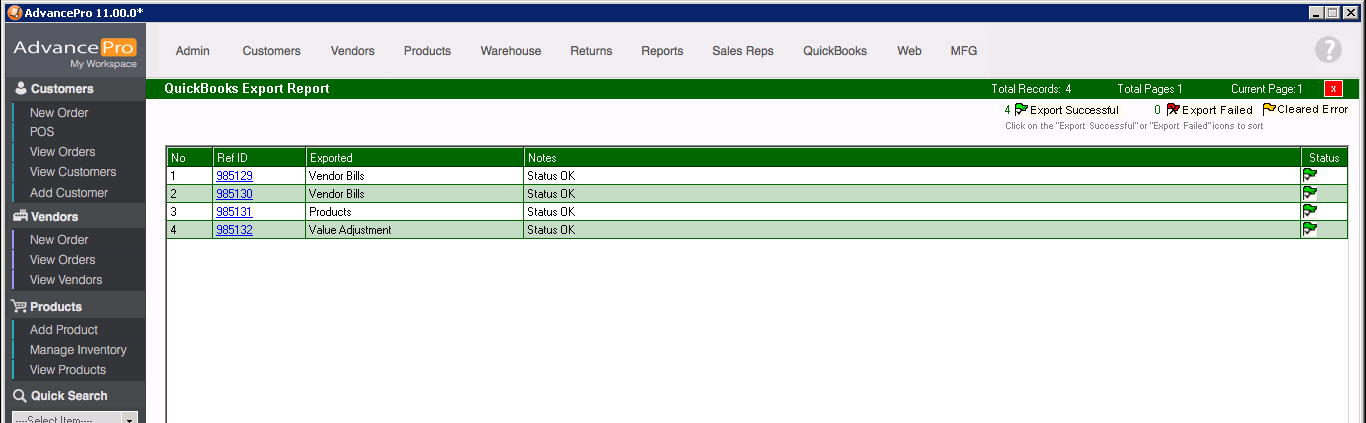

III. EXPORTING TO QUICKBOOKS

Note: Make sure you have finished the steps on the section "SETTING IT UP" before exporting any bills

For every Bill with Landed Cost Export, you will expect the below export report details:

1. The Vendor Bill for the original purchase

2. The Vendor Bill for the Landed Cost

3. One line for each Product purchased on the Vendor Bill

4. The Value Adjustment Line - this contains the adjustment to be applied on the Clearing Account, "Freight and Landed Costs"

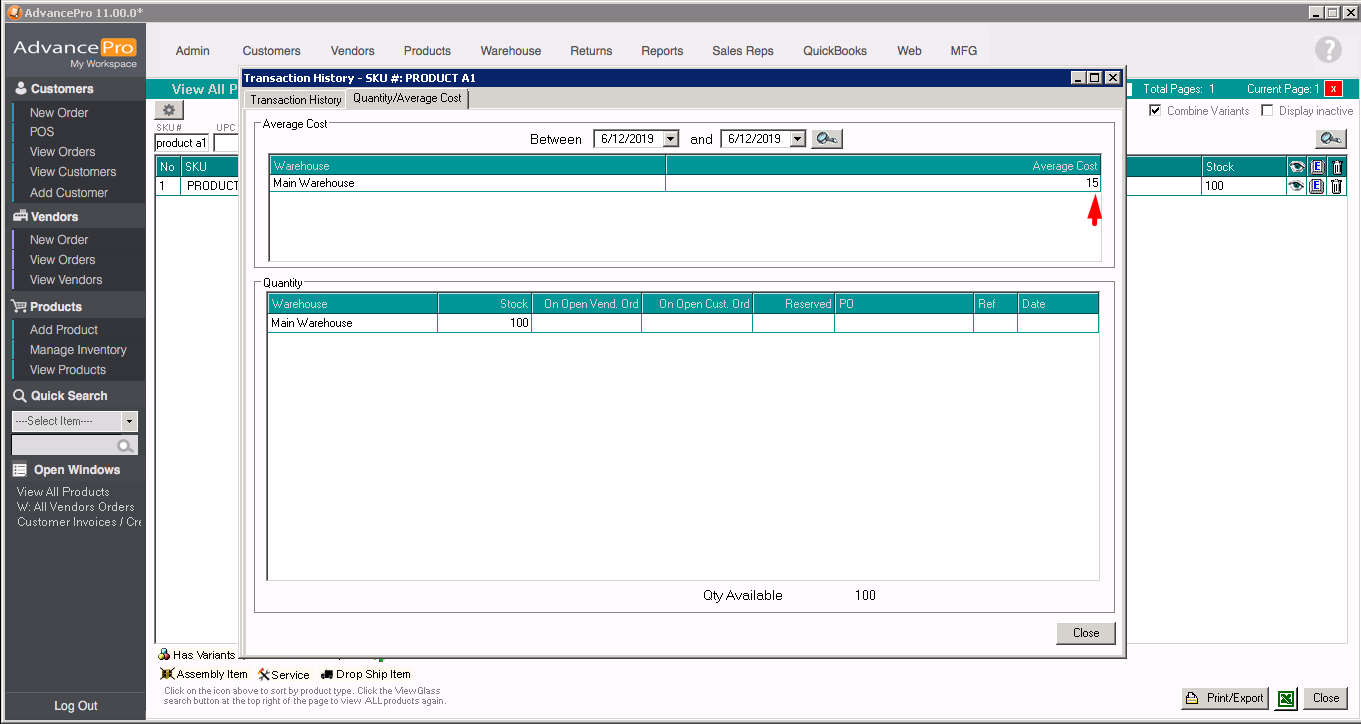

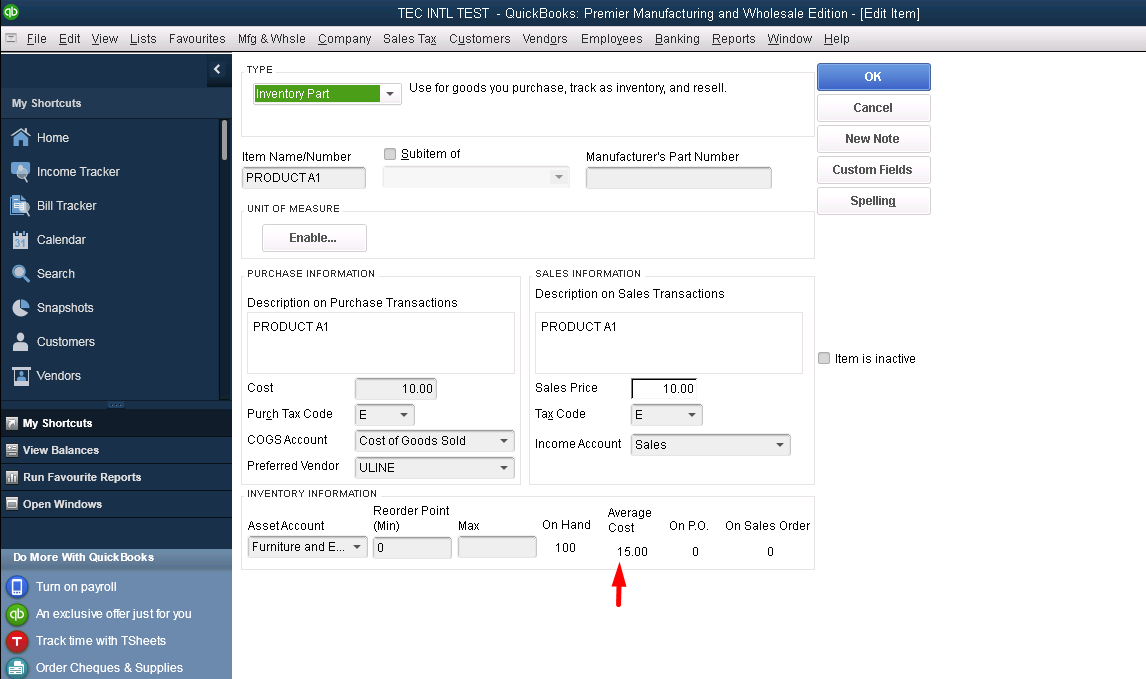

AVERAGE COSTS

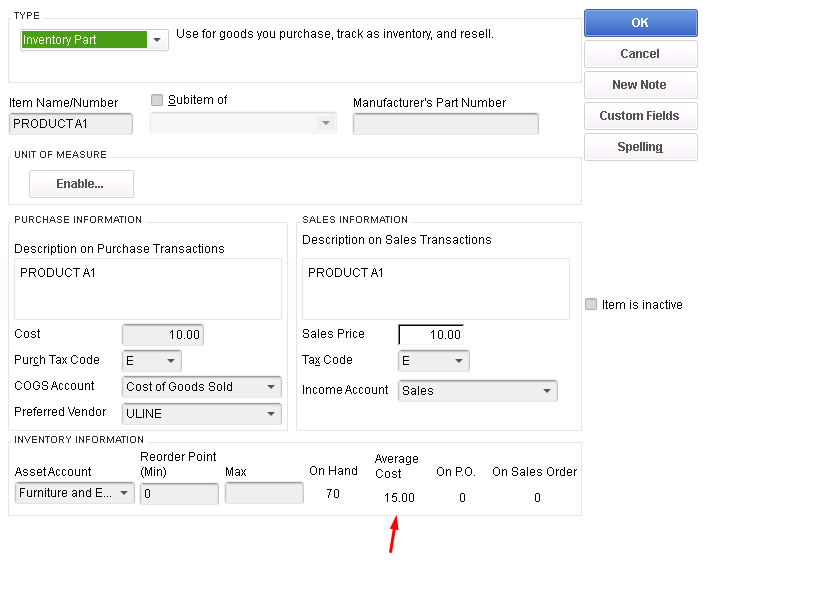

After billing, check if AdvancePro and QuickBooks' Average Cost amounts have been updated

AdvancePro: View All Products >> Eye Icon >> Quantity/Average Cost Tab

QuickBooks: Item List >> Edit Product >> Average Cost Field

STOP!

Have you completed all the setup on this section? If you have, you can proceed to the next setup:

IV. CHECKING QUICKBOOKS LANDED COST EXPENSE

💡

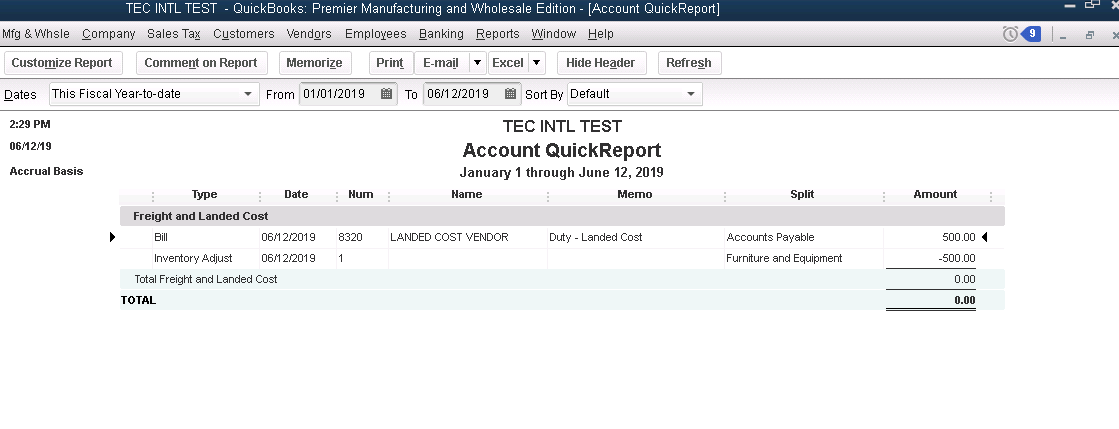

IV. CHECKING QUICKBOOKS LANDED COST EXPENSE

If all of the above setup has been correctly applied, the Landed cost will be recorded on the proper Expense Account on QuickBooks

Chart of Accounts >> Freight and Landed Cost account >> Run Quick Report

You will see that the Landed Cost worth $500.00 has been automatically recorded on this Account

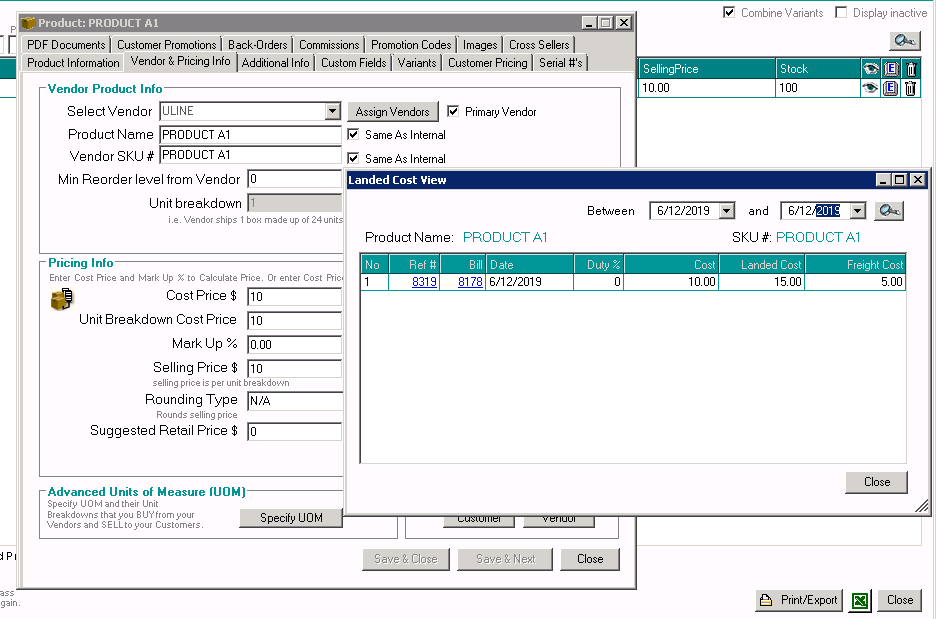

ADVANCEPRO LANDED COST

AdvancePro also keeps track of all Landed Cost history on Vendor and Pricing Info Tab >>

STOP!

Have you completed all the setup on this section? If you have, you can proceed to the next setup:

V. EFFECT ON COST OF GOODS SOLD

💡

V. EFFECT ON COST OF GOODS SOLD

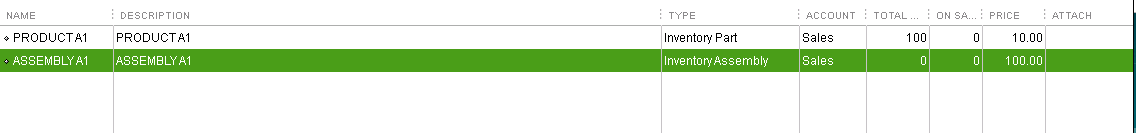

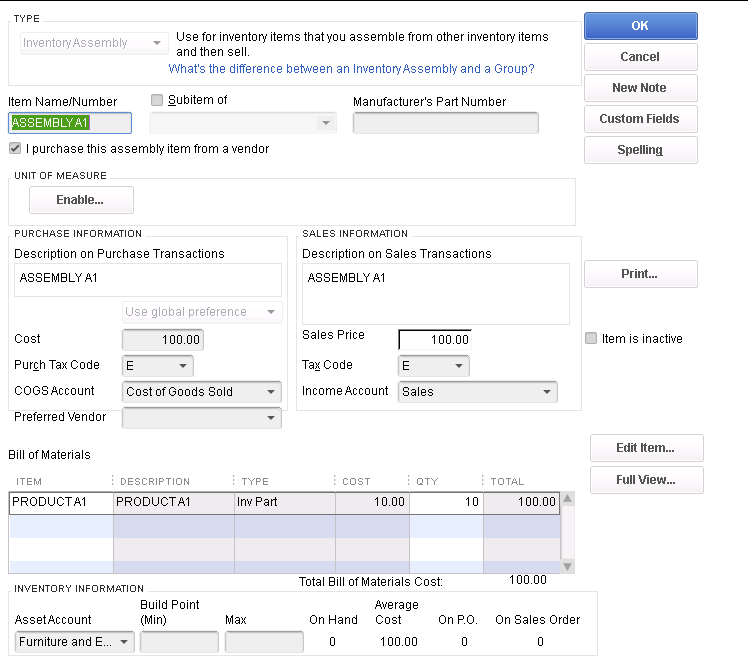

Suppose PRODUCT A1 is part of an Assembly Item, "ASSEMBLY A1"

ASSEMBLY A1 Bill of Materials:

PRODUCT A1 x 10 pcs

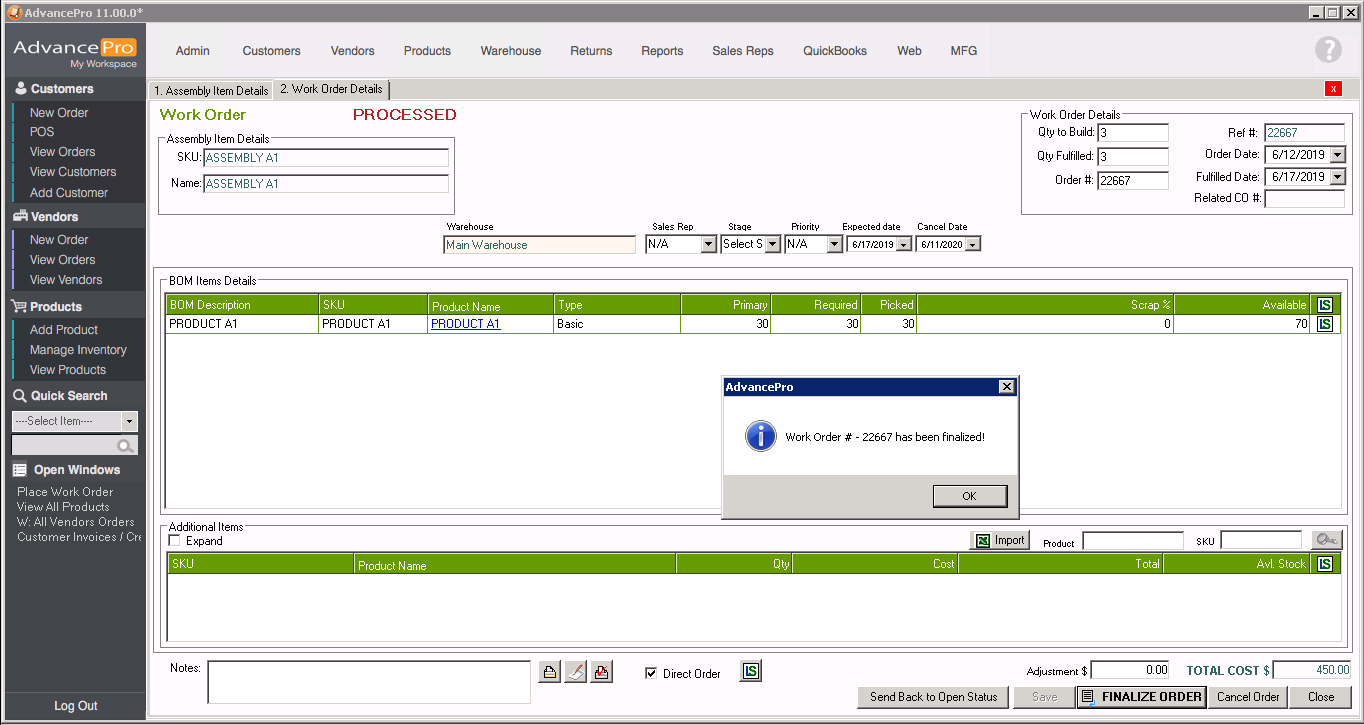

And a work order to build 3 of ASSEMBLY A1 has been created and finalized on AdvancePro

Export the BUILD to QuickBooks to build 3 ASSEMBLY A1's and reduce the component PRODUCT A1 by 30 units

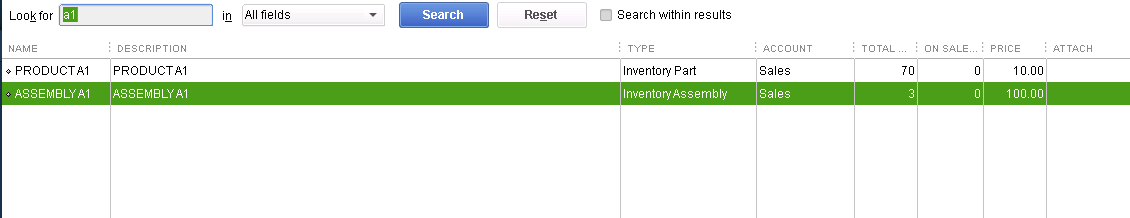

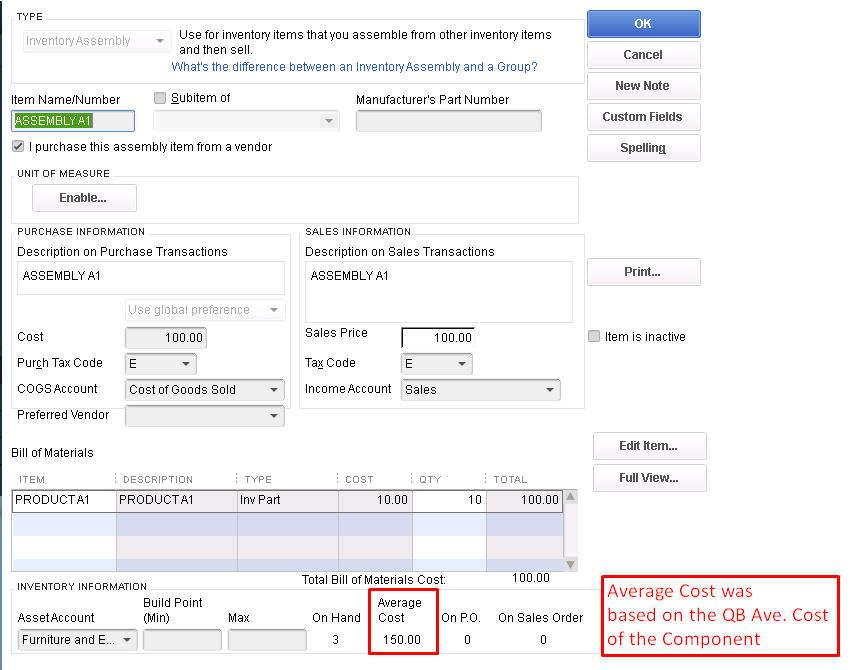

ASSEMBLY A1's Average Cost has been affected by the build as its component, PRODUCT A1 has been purchased with Landed Cost

AVERAGE COST OF ASSEMBLY A1

AVERAGE COST OF PRODUCT A1

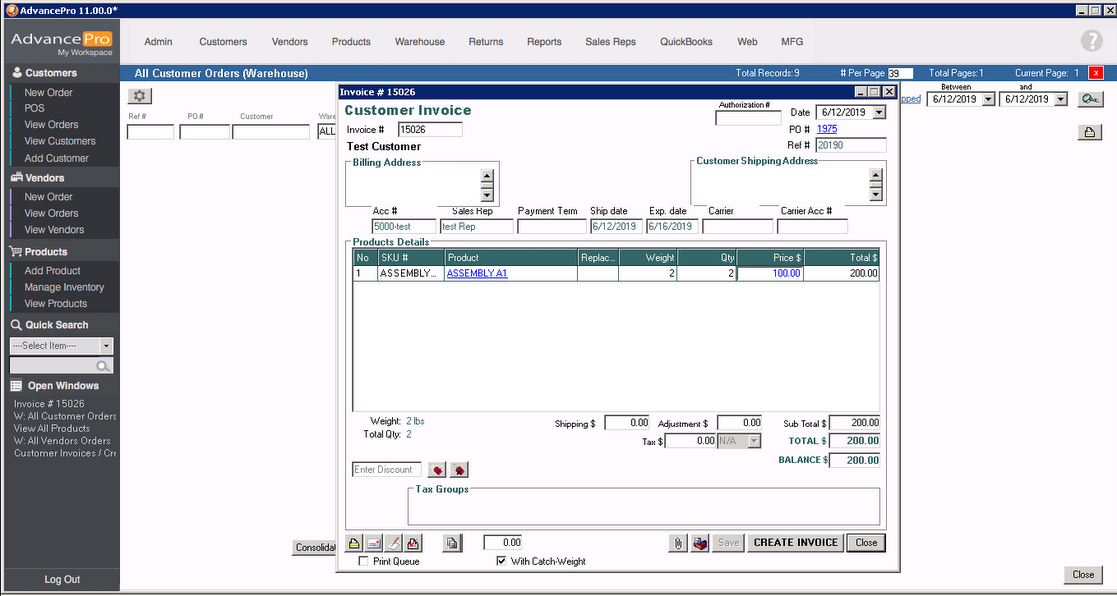

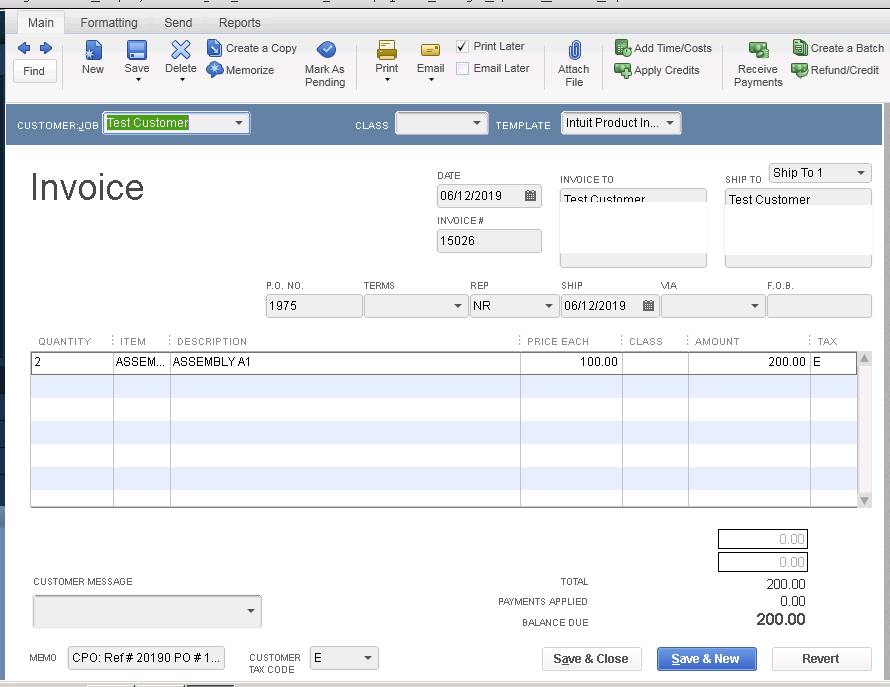

CUSTOMER INVOICE FOR ASSEMBLY A1

INVOICE ON ADVANCEPRO

EXPORTED INVOICE ON QUICKBOOKS

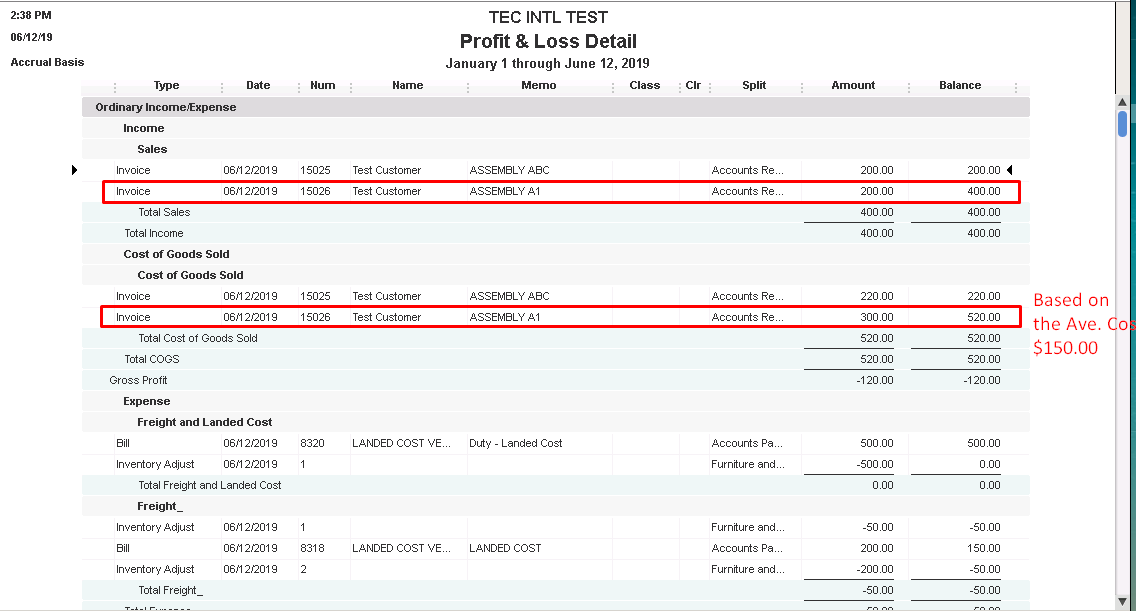

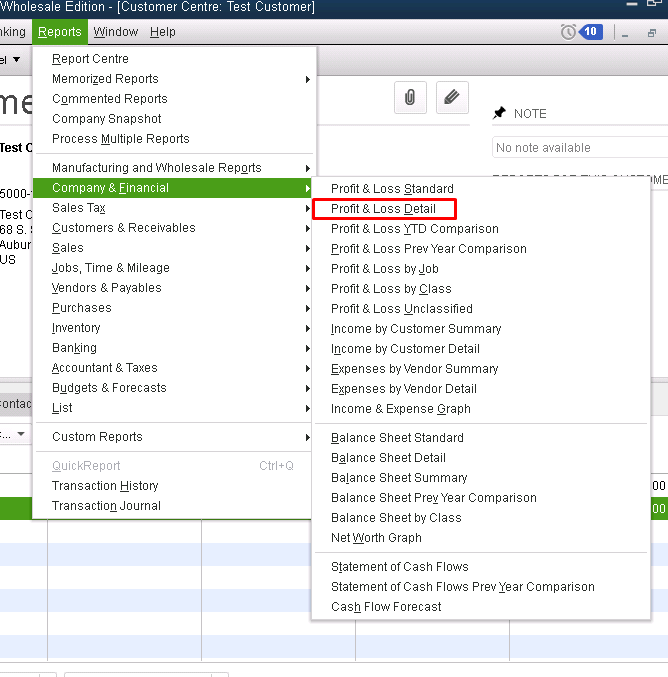

CHECK COST OF GOODS SOLD FOR THIS ASSEMBLY

Go to QuickBooks >> Reports >> Company & Financial >> Profit & Loss Detail

SAMPLE REPORT

The Assembly, "ASSEMBLY A1" has a COGS amounting to the products sold, and its current average cost.